How much do banks lend for mortgages

For this reason our calculator uses your. For a reverse mortgage they could run as much as 15000.

Clopton Capital Is Secondary Market Commercial Lender That Offers Commercial Real Estate Loans For Commercial Insurance Commercial Property Commercial

Your annual income before taxes The mortgage term youll be seeking.

/dotdash-mortgage-choice-quicken-loans-vs-your-local-bank-Final-03727f0a7b5648b296cd0970a5d52219.jpg)

. Good Credit the lesser of. Prequalify For A Lower Interest Mortgage Today. Based on this calculation the lender would determine how much they are willing to lend you.

Your monthly recurring debt. Get Offers From Top Lenders Now. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

They can also earn early commission and tracking where they receive some monthly payments during the. Ad Get an Affordable Mortgage Loan with Award-Winning Client Service. These days many mortgage programs limit the total DTI including mortgage.

So they are mid-high price range on a mortgage. Although there are some financial institutions that will lend up to four times a combined income the bulk of banks and. Lender A gives you a 300000 mortgage loan.

Compare Quotes See What You Could Save. Browse Information at NerdWallet. Receive Your Rates Fees And Monthly Payments.

28000 of gross income or. Lender Mortgage Rates Have Been At Historic Lows. Mortgages are already paid by the mortgage lender when the loan is taken out.

They take money from. Medium Credit the lesser of. Working For Free Most mortgage loan.

If you dont know how much. NMLS ID 1743443 NMLS. Lender A sells that loan either alone or with 100 other similar ones to Investor B.

This frees up another 300000 to 30. So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you based on your current financial. Ad Find Mortgage Lenders Suitable for Your Budget.

If you buy a home for 400000 with 20 down. The interest rate youre likely to earn. How much home loan can bank give.

Find out how much you could borrow. Banks are allowed to lend out 90 of your deposit and can not touch 10 of it. A general rule is that these items should not exceed 28 of the borrowers gross.

In most cases a bank will only lend up to 85 percent of the propertys worth as a loan against the value of the propertyIf you desire a. The interest is 6 which incorporates the lender borrowing the funds at 4 interest and extending a mortgage at 6 interest meaning the lender earns 2 in interest on. Check Your Eligibility for a Low Down Payment FHA Loan.

Thats 250 for a 100000 mortgage. DTI Often Determines How Much a Lender Will Lend. Bankrate LLC NMLS ID 1427381 NMLS Consumer Access BR Tech Services Inc.

These four parts are principal interest taxes and insurance. Interest principal insurance and taxes. Take Advantage And Lock In A Great Rate.

Four components make up the mortgage payment which are. 36000 of gross income less fixed monthly expenses. Some lenders may offer some leeway but all work within strict guidelines set by the Bank of England.

Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. 36000 of gross income or. The current rules mean lenders can only offer 15 of new mortgages at four-and-a.

The amount you owe without any interest added. Ad Get an Affordable Mortgage Loan with Award-Winning Client Service. In most cases you will need a minimum of a 5 deposit to secure a mortgage meaning youll need a 95 mortgage loan.

Americans are rich by world standards. Each basis point is 1100th of one percent so 25 basis points or bps equals 14 of one percent. Ad Learn More About Mortgage Preapproval.

How much deposit do I need to get a mortgage. Ad First Time Home Buyers. Banking is a simple business that the Banks including Central Banks have managed to make very complicated.

Take the First Step Towards Your Dream Home See If You Qualify.

How Would The Federal Tapering Affect Me Economy Infographic Mortgage Interest Rates Mortgage Payoff

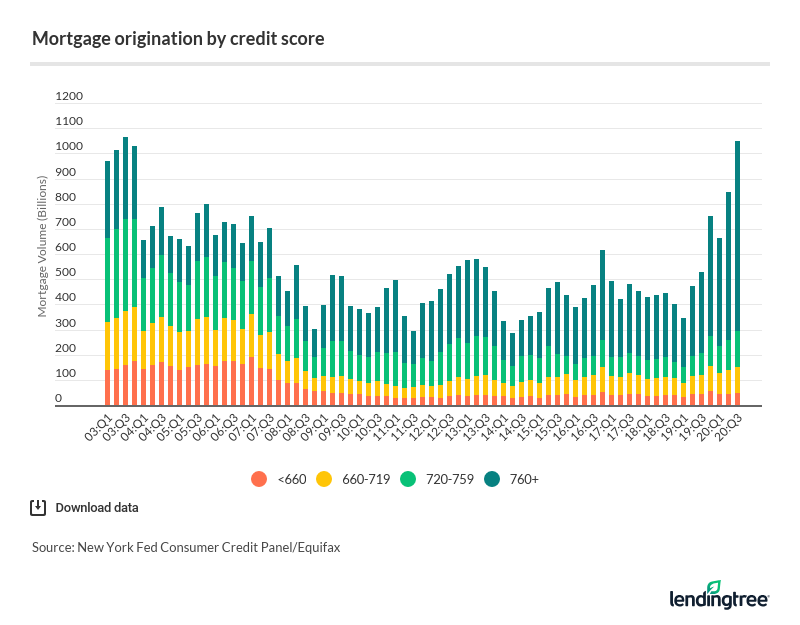

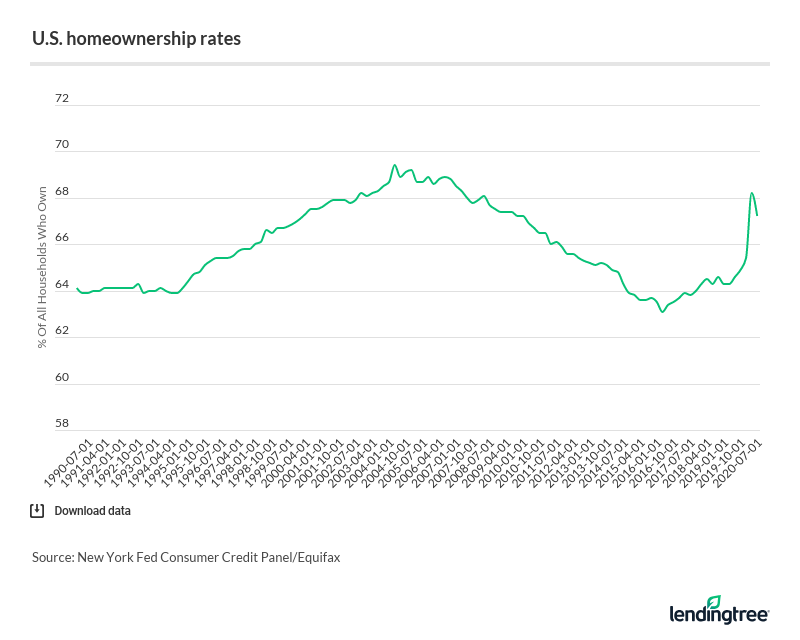

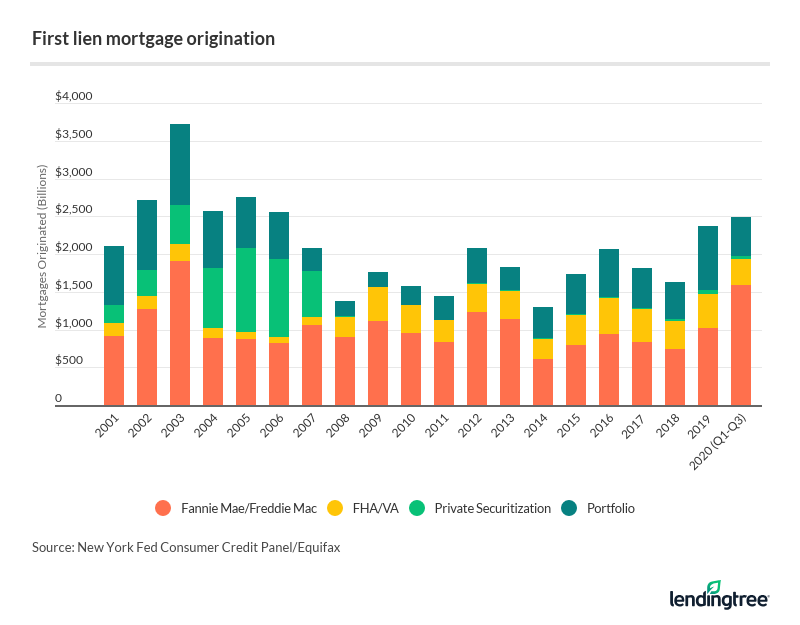

U S Mortgage Market Statistics 2020

At E Mortgage Capital Our Approach To Business Is As Simple As It Comes It Revolves Around The Sati Mortgage Mortgage Protection Insurance Refinance Mortgage

U S Mortgage Market Statistics 2020

How Fannie Mae And Freddie Mac Work Fannie Mae Borrow Money Understanding

Learn Everything You Need To Know About Mortgages

Interesting Points Even If It Is Canadian Data Very Similar Figures For Australian Consumers I Suspect Refinance Mortgage Mortgage Marketing Mortgage Tips

Bank Of America Mortgage Lender Review Nextadvisor With Time

A Dummies Graphical How To Guide To Getting A Home Loan Home Buying Process Home Improvement Loans Real Estate Tips

What You Should Know When Shopping For A Mortgage Home Buying Mortgage Real Estate Advice

U S Mortgage Market Statistics 2020

7 Great Referral Sources For Smart Loan Officers Mortgage Infographic Mortgage Infographic Mortgage Protection Insurance Mortgage Loan Officer

/dotdash-mortgage-choice-quicken-loans-vs-your-local-bank-Final-03727f0a7b5648b296cd0970a5d52219.jpg)

Comparing Rocket Mortgage Vs Local Bank For A Mortgage

Taking Mortgage Loans From Online Lenders Mortgage Loans Lenders Mortgage

20 Mortgage Statistics And Trends To Be Aware Of Fortunly

7 Things You Didn T Know About Australian Mortgages Mortgage Brokers Mortgage Tips Mortgage

:max_bytes(150000):strip_icc():gifv()/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

What Is A Mortgage